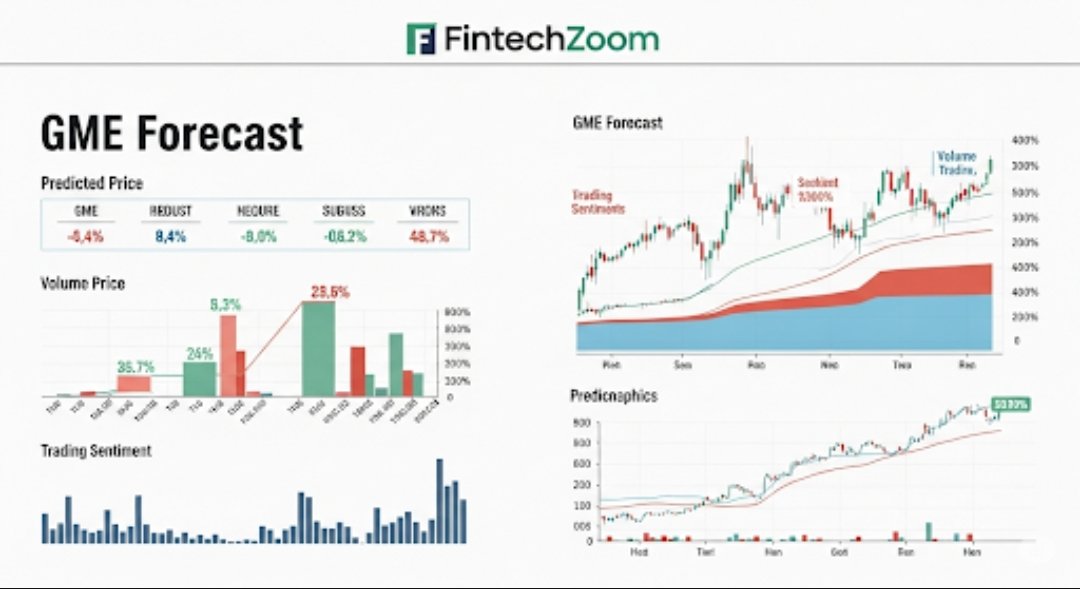

Fintechzoom GME Stock Forecast: What Investors Need to Know in 2025

The stock market can be unpredictable, especially when it comes to high-volatility stocks like GameStop (GME). Once a struggling video game retailer, GME became the face of a retail investing revolution in 2021. Today, investors still watch it closely—and many turn to detailed resources like the fintechzoom gme stock forecast to help guide their decisions.

In this article, we’ll take a closer look at what’s driving GME in 2025, why it remains such a hot topic among both retail and institutional investors, and how tools like FintechZoom can provide valuable insight. Whether you’re a seasoned trader or someone just getting started, understanding this stock’s potential trajectory is crucial.

The GameStop Story Isn’t Over

GameStop became a household name during the meme stock frenzy. Powered by retail investors from Reddit’s WallStreetBets community, the stock skyrocketed far beyond what traditional analysts predicted. But while the hype may have faded slightly, GME’s underlying narrative is still evolving.

The company has taken significant steps toward transforming its business model—from brick-and-mortar game retailing to a more digital, e-commerce-focused operation. The appointment of Ryan Cohen (Chewy co-founder) as Chairman, and now CEO, has brought new strategic direction and investor confidence.

That’s where insights from the fintechzoom gme stock forecast become valuable. It combines financial analysis with news trends, technical indicators, and market sentiment to provide a comprehensive outlook.

What Influences the Fintechzoom GME Stock Forecast?

There are multiple factors that shape any stock forecast, especially for a company as volatile and community-driven as GameStop. The fintechzoom gme stock forecast takes into account several critical components:

- Technical Analysis

GME stock is heavily traded, meaning technical indicators like moving averages, RSI (Relative Strength Index), and Bollinger Bands can offer short-term trading signals. FintechZoom evaluates these trends to project momentum shifts. - Fundamental Performance

While meme momentum may come and go, real financials matter. FintechZoom’s forecast includes earnings reports, revenue growth, profit margins, and debt management—all key to understanding the stock’s long-term potential. - Market Sentiment

GME’s price often reacts to online chatter. Tools like sentiment analysis track what’s trending on platforms like Reddit, X (formerly Twitter), and Discord. These insights are integrated into the fintechzoom gme stock forecast to gauge possible price moves. - Economic Indicators

The broader economy also impacts GME. Inflation, interest rates, and consumer spending all affect how much people are willing to invest in speculative stocks.

Is GME Still a Buy in 2025?

That’s the million-dollar question. According to recent updates from the fintechzoom gme stock forecast, the outlook is cautiously optimistic. While GME may not see the meteoric rise it did in early 2021, there are signs of stability and slow growth—especially if the company successfully continues its digital transformation.

However, it’s worth noting that GME is still highly speculative. The stock experiences sharp ups and downs, often disconnected from fundamentals. This is why a tool like the fintechzoom gme stock forecast is helpful: it synthesizes multiple perspectives and gives investors a clearer picture of both risks and opportunities.

A Human Perspective: Lessons from GME’s Wild Ride

Behind every ticker symbol is a community of people—investors, traders, employees, and consumers. GME isn’t just a stock; it’s become a symbol of retail investor empowerment. The events of 2021 reminded the financial world that Wall Street no longer has a monopoly on market movements.

From a personal investment standpoint, many small investors saw life-changing gains—or painful losses—from GME. That’s why approaching the stock with well-researched tools, like the fintechzoom gme stock forecast, is essential today. It’s not just about chasing a quick buck—it’s about being informed, strategic, and aware of the broader context.

Final Thoughts: What Comes Next?

As GameStop enters its next chapter in 2025, it remains a stock worth watching—whether you view it as a meme stock or a turnaround story. The evolution of its business model, leadership, and online community will continue to influence its price.

For anyone considering a move in or out of GME, the fintechzoom gme stock forecast offers a reliable lens through which to evaluate the stock. It doesn’t promise certainty—no forecast can—but it does provide the clarity and data needed to make more confident decisions.